Key takeaways

From 1 January 2026, all acquisitions above set thresholds (unless exempt) must be notified to the ACCC, marking a shift from the current voluntary system.

The new regime introduces strict review timeframes, public registers, and risk-based economic assessments to enhance oversight of mergers.

These reforms aim to tackle Australia’s “competition crisis” by preventing anti-competitive acquisitions and protecting consumers in highly concentrated industries.

The Australian Competition and Consumer Commission (ACCC) was established to protect consumer welfare and competition within Australia, and it pursues this goal (in part) by overseeing merger and acquisition activity within the Australian economy.

In an effort to support the ACCC’s discharge of its duties, Parliament recently enacted legislative changes to Australia’s merger control regime by introducing mandatory notification requirements for specified acquisitions.1

New mandatory regime

Under the current transitionary arrangements, businesses can voluntarily seek the ACCC’s view on whether a proposed merger is likely to substantially lessen competition by either:

- continuing to use the (soon-to-be replaced) informal review process; or, alternatively

- notify the ACCC of the proposed transaction under the new merger regime.

However, from 1 January 2026, ACCC clearance will become mandatory for all acquisitions of shares or assets connected with Australia2 which are above certain prescribed monetary thresholds, and which do not fall within an exemption (Notifiable Acquisitions).3

The relevant monetary thresholds (Notification Thresholds), which are described below in detail, are related to the revenue generated by the merger parties and their connected entities4 within Australia as at the date on which the parties enter into any contract, arrangement or understanding regarding the Notifiable Acquisition.

The Notification Thresholds fall within the following broad categories:

- Acquisitions resulting in large or larger corporate group.

- Acquisitions by very large corporate groups.

- Creeping or serial acquisitions.

- Targeted thresholds (related to supermarket acquisitions).

However, Parliament has announced exemptions from the mandatory notification regime for various types of acquisitions which result in the acquire obtaining control over the target (Exemptions), including certain land acquisitions and the acquisition of financial securities in certain situations (such as rights issues, buy-backs, and the underwriting of fundraising). If a proposed acquisition meets the Notification Thresholds but otherwise falls within an Exemption, the acquisition will not require notification to the ACCC.

The ACCC has since continued to refine these Exemptions based on its experiences during the transitional, voluntary phase of the regime. In particular, the regulator has broadened the operation of the Exemptions in relation to low-risk business activities in the areas of residential property development, retail trade and financial markets. The ACCC has at this stage provided only a high-level outline of the key changes, being:

- Exemptions for leases and other acquisitions of interests in land in the ordinary course of business (unless subject to targeted notification requirements).

- Simplification of the approach to Notification Thresholds for asset acquisition.

- Streamlining notification obligations around serial acquisitions.

- Clarifying and expanding existing exemptions applicable to financial market activities.

The Government plans to implement these changes through subordinate legislation ahead of the commencement of the new regime on 1 January 2026. Importantly, by virtue of being made by legislative instrument, further amendments to the Notification Thresholds and Exemptions may be made in the future.

Notification Thresholds

Competition crisis

According to the ACCC, the mandatory notification process will provide faster timeframes and greater transparency for transacting parties by streamlining the ACCC’s approach to identifying and preventing anti-competitive acquisitions.5

These reforms represent a major shift in the regulation of M&A activity within Australia. As noted above, notification of acquisitions to the ACCC is currently conducted on a voluntarily basis by businesses seeking to reduce the risk of legal action being brought against them for anti-competitive mergers. The introduction of mandatory notification requirements sends a clear and timely signal to the market of the ACCC’s role in protecting consumers, and the broader community, from the economic harm caused by anti-competitive transactions.

The Australian economy is already notoriously concentrated, with large firms dominating a range of industries including banking, mining, aviation and supermarkets. This increasing concentration of market power raises concerns about the potential negative implications for innovation, consumer choice and the long-term health of the economy.6

While the timing of the regime’s roll-out may be somewhat ironic, given some commentators are calling for reduced regulation to improve productivity,7 it is important to note that these changes are intended to bolster the ACCC’s ability to effectively address “Australia’s silent and growing competition crisis”.8

Notification requirements and analysis

According to the ACCC, application reviews will be conducted using a risk-based approach. An economic analysis, supported by data, will be undertaken at each stage of a merger review to determine the likely effect of the acquisition on competition and the associated long-term impacts this may have on the community, and whether the clearance application in question can be determined at an early phase of the review process (described further below).9

This approach relies on the ACCC having access to all relevant information and data necessary to effectively conduct its assessments. To facilitate this process, the ACCC is encouraging pre-lodgement engagement with merger parties to ensure clarity on the ACCC’s information requirements and to assist the ACCC in assessing notifications as efficiently and quickly as possible. It is also suggested that this early engagement will be helpful to assist merger parties in understanding whether their proposed acquisition sits above or below the Notification Thresholds, thereby reducing the regulatory burden on Australian businesses and the ACCC.10

Waiver applications

From 1 January 2026, businesses may apply to the ACCC for a waiver of the mandatory notification requirements, even where the proposed acquisition meets the Notification Thresholds. Any waiver granted by the ACCC removes the obligation on the parties to notify the acquisition and pay the corresponding notification fee.

In considering waiver applications, the ACCC will take into account (among other things) the interests of consumers and the likelihood that the acquisition would, if it were put into effect, substantially lessen competition in any market.11

The waiver process is separate from the Exemptions, and the ACCC has indicated that it does not anticipate that waiver applications will be commonplace. More information regarding the waiver application process, including the application fees payable, will be released by the ACCC in due course.

Greater transparency

If the ACCC determines to approve an acquisition, it may either be on the basis of the transaction as notified, or otherwise on the basis of commitments given by the merger parties or conditions imposed by the ACCC or the Australian Competition Tribunal.11

With some limited exceptions,12 all acquisitions notified to the ACCC for clearance and all waiver applications (from 1 January 2026) will be published by the ACCC on the public acquisitions register,13 together with the reasons for the ACCC’s final determinations. According to the ACCC, this approach will promote increased transparency into the review process, allowing market participants a greater understanding of the reasoning which underpins the ACCC’s determinations and, over time, creating a “useful database and point of reference for stakeholders and advisors, the broader business and wider community.”14

New guidelines have also been published on the ACCC’s website to assist merger parties and their advisers in understanding the analytical framework which the ACCC will apply when assessing Notifiable Acquisitions under the new regime.

Timeframes

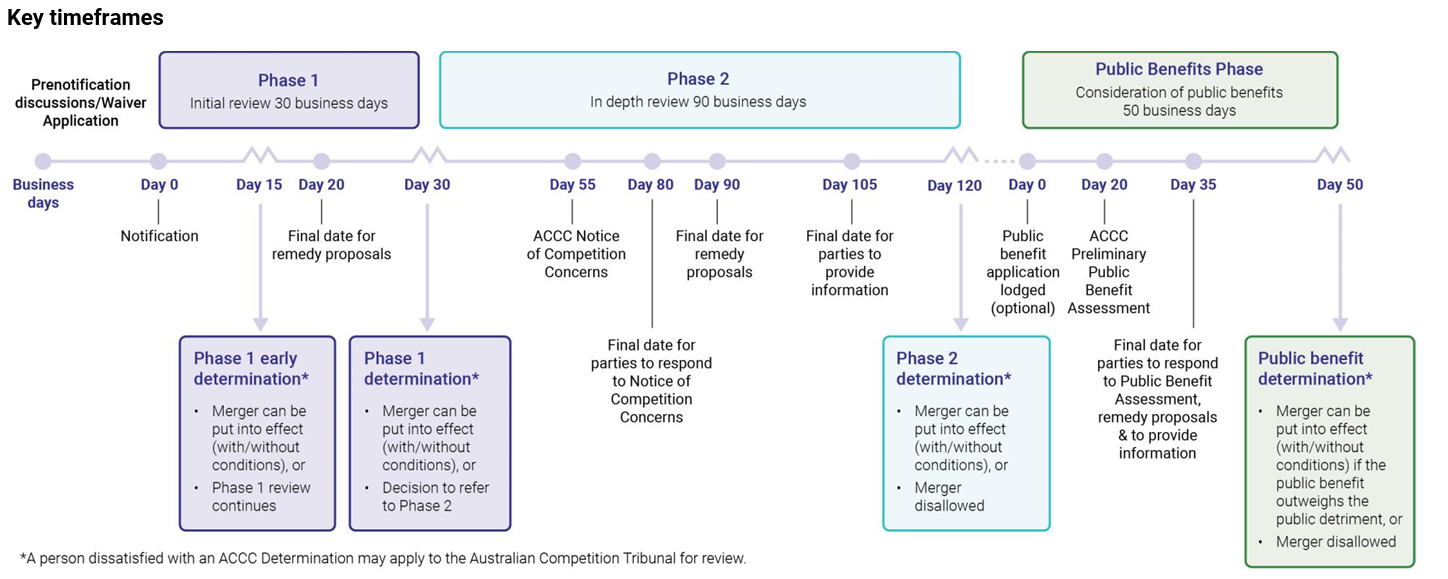

If the ACCC does not make its determination under the new regime within the strict ‘Phase1’ and ‘Phase 2’ statutory timeframes described below (subject to any allowable extensions), the ACCC will be deemed to have determined that the acquisition in question may be put into effect by the parties.16

An extract of these timeframes from the ACCC’s ‘Statement of Goals for Merger Reform Implementation’ is set out below, showing a review process which spans a maximum of three phases and two hundred business days (or approximately ten months) from the date of the initial notification.

Phase 1 assessments may run for up to 30 business days (subject to any extensions) with the earliest approvals being provided after 15 business days. If further assessment of an acquisition is required, the application will move into Phase 2 which may continue for up to 90 business days (subject to any extensions) in addition to the Phase 1 period.

If, after a Phase 2 determination, the ACCC does not approve an acquisition, or grants conditional approval, and the parties consider the acquisition will likely result in a net public benefit, they may apply for a separate assessment of the likely public benefits and detriments. The ACCC then has up to a further 50 business days (subject to any extensions) to consider the public benefit application.

While these strict review timeframes are certainly a significant shift from the current, more flexible approach, it may not be wise for parties undertaking complex transactions with competition implications to plan for a quick clearance under the new regime.

Transitional arrangements

According to the ACCC's guidance, any informal review applications submitted on or after 1 October 2025 are unlikely to be completed before the new merger regime comes into effect on 1 January 2026.

Any applications made under the transitional arrangements which have not been cleared by the ACCC before 31 December 2025 will be listed on the public register as having ‘no decision’, and the ACCC will discontinue its review. Parties who do not receive ACCC informal clearance by 31 December 2025 will need to recommence the notification process under the new merger regime (if the Notification Thresholds are met).

Acquisitions which are approved under the current transitional arrangements before 31 December 2025 will not be required to comply with the notification process again under the new regime provided that the transaction is completed within 12 months – otherwise, parties will be required to comply with the mandatory notification regime in full.

Fees and Penalties

There are considerable fees payable at each stage of the ACCC’s review process under the new mandatory notification regime, and significant penalties may be imposed for failure notify (in addition to the acquisition in question being stayed – that is, it cannot be put into effect). Penalties may also be imposed in other circumstances, including where parties provide false or misleading information to the ACCC as part of the notification process17 or as a result of any non-compliance with a condition imposed by the ACCC in its determination.

Next steps

By providing a more efficient, predictable and transparent merger process for businesses, underpinned by enhanced data and economic analysis and increased monitoring, the new regime is said to reflect the ACCC’s commitment to improving competition outcomes for the wider community.

However, the real world impacts of this new mandatory reporting regime on competition (and productivity) within Australia will not be fully understood for some time yet.

For now, parties should be aware that the transitionary arrangements are almost over, and begin preparing for the new mandatory regime to commence on 1 January 2026.

We're ready to assist

1 On 28 November 2024, both Houses passed the Treasury Laws Amendment (Mergers and Acquisitions Reform) Bill 2024 which amends the Competition and Consumer Act 2010 (Cth) to replace the existing framework for mergers review with a mandatory and suspensory administrative system for acquisitions, together with consequential amendments to five other Acts. See Parliament website here for more information.

2 ‘Connected with Australia’ means shares in the capital of a body corporate (if acquiring shares) or an interest in, or asset used by, an entity (if acquiring assets) that carries on a business in Australia: section 1-6 of Competition and Consumer (Notification of Acquisitions) Determination 2025 (Cth).

3 With the exception of supermarket acquisitions, which are notifiable regardless of the value of the transaction.

4 Meaning those entities which are associated with, or controlled by, the merger parties: section 1-5 of Competition and Consumer (Notification of Acquisitions) Determination 2025 (Cth).

5 ACCC, ‘Statement of Goals for Merger Reform Implementation’, 10 October 2024, page 8.

6 ACCC, ‘Domestic airline competition in Australia’, May 2025 – linked here; ACCC, ‘Supermarkets Inquiry – Final Report’, February 2025 – linked here; Australian Broadcasting Corporation, Gareth Hutchens, ‘Large firms dominate Australia's economy and it's costing you money, says Labor MP Andrew Leigh’, 25 August 2022 – linked here.

7 Australian Broadcasting Corporation, Maani Truu and Olivia Caisley, Focus narrows on reducing regulation to boost productivity ahead of round table, 18 August 2025 – linked here.

8 The Conversation, Dan Andrews and Elyse Dwyer ‘Flying under the radar: Australia’s silent and growing competition crisis’, 30 August 2023 – linked here.

9 Above n 4, page 8.

10 Above n 4, page 7.

11 For more information see the ACCC’s ‘Merger process guidelines’ at page 13.

12 Above n 4, page 8.

13 For example, surprise hostile takeovers unless withdrawn or certain voluntary transfers under the Financial Sector (Transfer and Restructure) Act 1999. See above n 4, page 6.

14 For more information see the ACCC’s website here.

15 See above n 4, page 7.

16 However, this approach does not apply to the Public Benefits Phase – if the ACCC does not make a determination within the statutory timeline (subject to any allowable extensions) the ACCC will be deemed to have not made the public benefit determination applied for and the determinations under Phase 1 or Phase 2 will stand.